Wise stands out in the crowded field of international money transfers by being consistently recognized as the fastest way to send money abroad. According to their own data, 64% of transfers arrive in under 20 seconds, and a remarkable 95% settle within one day. Whether you need to transfer money internationally to a loved one, pay overseas suppliers or handle urgent remittances, Wise delivers fast, straightforward transactions that you can count on.

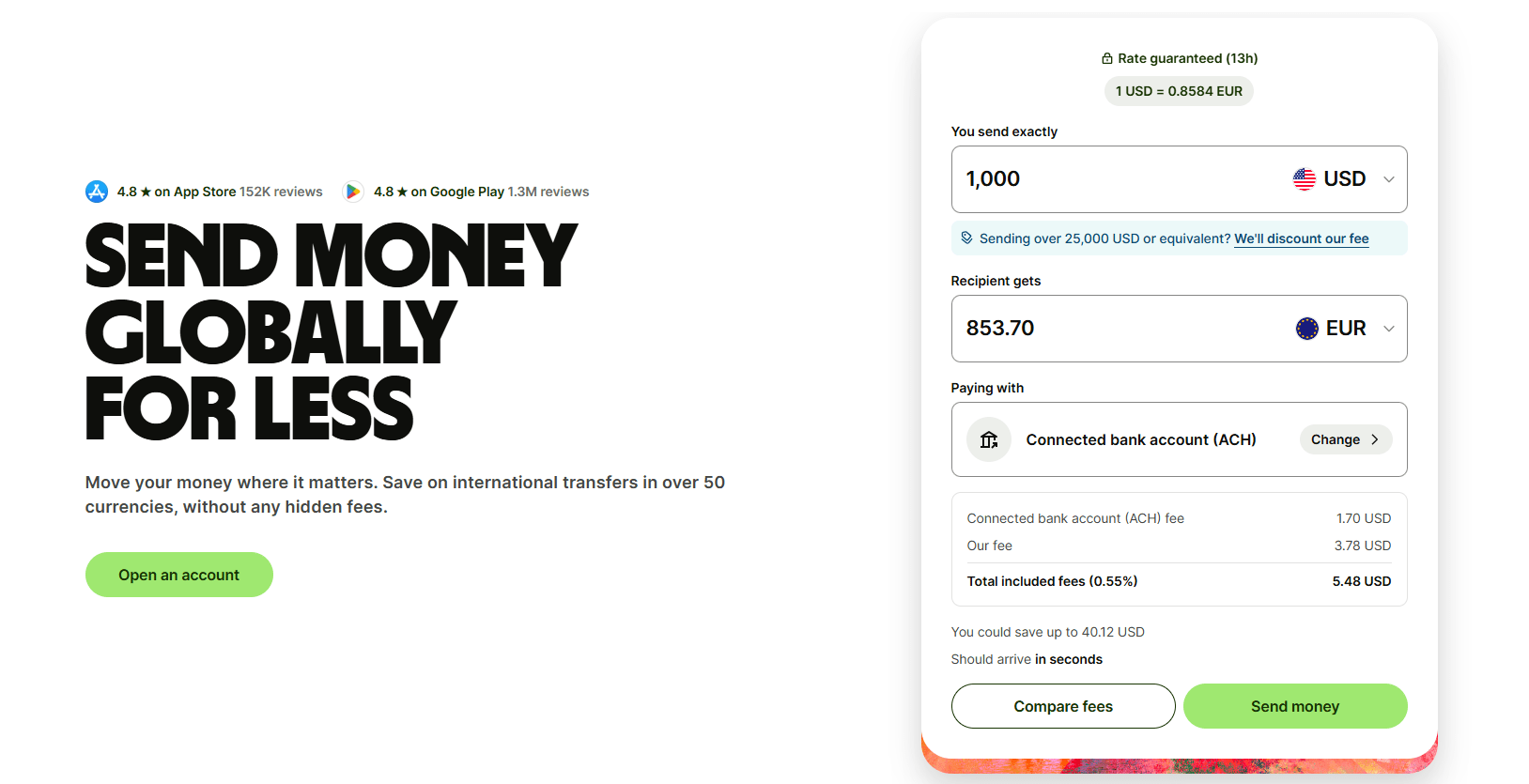

Unlike many traditional banks that skimp on clarity by tacking on hidden exchange-rate markups, Wise shows you the mid-market rate you’d see on Google. Fees are always upfront and baked into the amount you send. The platform doesn’t just cater to personal transfers. Its Wise business account makes it simple to transfer money from Wise to a bank account, especially when managing cross-border business payments. You can pay out and get paid in over 40+ currencies, all while combining simplicity and professionalism.

Beyond transfers, Wise offers a robust multi-currency account, hold, convert and manage funds across 23 currencies effortlessly. For frequent travelers or international professionals, the Wise card lets you spend and withdraw in 215 countries without annoying foreign transaction fees. And if you’re looking to grow your USD, GBP or EUR balances, you can opt into a savings feature that accrues interest with FDIC-insured protection up to $250,000 via partner banks though availability depends on your location.

Wise handles around $10 billion in global monthly transfers and leverages over 1,000 specialists plus advanced fraud systems to keep your funds safeguarded. Regulated across numerous jurisdictions, it ensures your money is securely held in segregated accounts.

In conclusion, whether you’re looking to receive money via Wise, use their fastest international money transfer capability or explore their wise banking features, Wise remains a top choice. It’s fast, transparent, secure and versatile; perfect for individuals and businesses seeking a hassle-free way to move money across borders.

Also Read: The Best Digital Payment Solutions for E-Commerce in 2025

Disclosure: This post may contain affiliate links, which means if you make a purchase through my links, I may earn a small commission at no extra cost to you.