The online business realm is evolving with numerous innovations, but one thing remains constant: payment gateways. Choosing the right payment solution is critical for business success. The best payment solutions for e-commerce in 2025 are designed to offer security, convenience and flexibility, enabling businesses to handle local and international transactions efficiently.

These tools are more than tools for transactions, but gateways to global opportunities. With increasing market demand for secure online payment systems, businesses must adopt reliable platforms to build trust, ensure smooth customer experiences and handle the complexities of cross-border commerce.

Choosing the right platform can be daunting, but this guide simplifies the process, highlighting the best options tailored for diverse markets and business needs. Whether you’re looking for low-cost payment solutions for small businesses and tools for managing cryptocurrency transactions or specialized platforms for African and Latin American markets, understanding the features and benefits of these solutions will help you navigate the complexities of global e-commerce with confidence.

This article explores leading payment solutions that empower e-commerce businesses with cutting-edge features and cost-effective operations. We’ve researched and tried 7 tools that can transform your e-commerce business depending on your custom preferences.

Table of Contents

Choosing the Best Payment Gateway for E-Commerce

Finding the right payment solutions for e-commerce in 2025 begins with identifying your business needs. Do you require support for international transactions or e-commerce tools for accepting cryptocurrency payments? Are you targeting specific markets like Africa Asia, United States, Europe or Latin America? Consider factors such as transaction fees, compatibility with your e-commerce platform, ease of integration and the availability of localized payment methods.

Additionally, security is paramount. Choose platforms that offer secure online payment systems, ensuring protection against fraud and data breaches. Customer trust is built on seamless, safe transactions, especially when handling sensitive financial information. By assessing your business’s priorities and comparing features, you’ll find a payment solution that not only supports your operations but also enhances your customer experience.

1. Flutterwave

Flutterwave is a versatile payment gateway designed to simplify online transactions for businesses, particularly those targeting African markets. The platform supports over 150 currencies and offers multiple payment methods, including mobile money, cards and bank transfers. Flutterwave’s standout feature is its ability to localize payments, ensuring that businesses can connect with customers in specific regions effectively. It comes on the first spot of the best payment solutions for e-commerce in 2025 to any size of business.

Flutterwave provides an integrated e-commerce solution through the Flutterwave Store, allowing businesses to start selling online without the need for a dedicated website. Its advanced fraud protection mechanisms ensure secure transactions, while 24/7 customer support offers peace of mind for businesses and customers alike.

Flutterwave’s extensive integration options make it compatible with popular platforms like WooCommerce, Shopify, and more, enabling quick and seamless setup. The platform is especially suitable for businesses looking for best payment platforms for African e-commerce, but it is steadily expanding its reach into global markets.

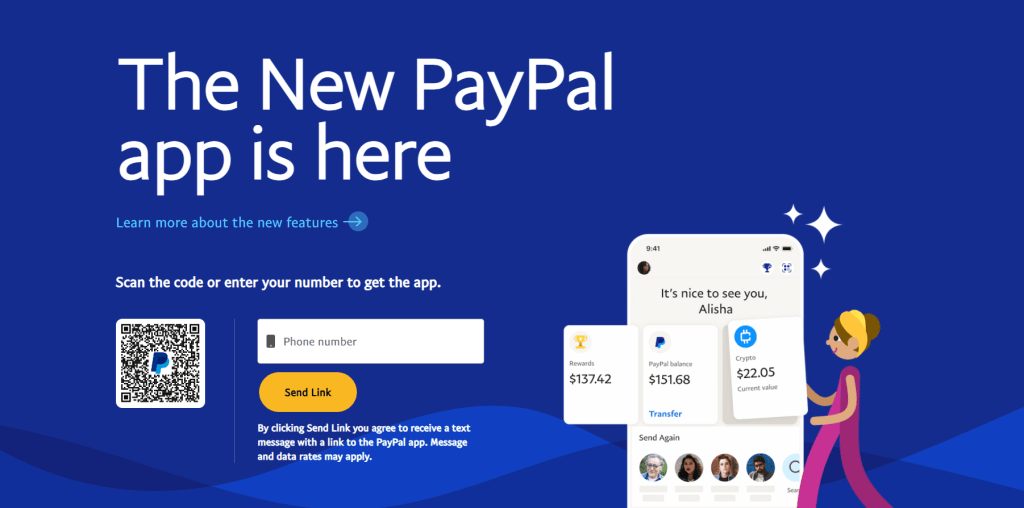

2. PayPal

PayPal remains a trusted and widely recognized name in the world of online payments. With support for over 200 countries and 100 currencies, it has become a global standard for e-commerce transactions. PayPal’s platform is designed for convenience and security, offering buyers and sellers protection to foster trust in digital transactions. Which makes it on the list of the best payment solutions for e-commerce in 2025.

One of PayPal’s key strengths is its seamless integration with most major e-commerce platforms, enabling businesses to accept payments without extensive technical expertise. PayPal Checkout, a specialized feature, enhances the customer experience by streamlining the payment process.

While PayPal’s reputation as a secure online payment system is unmatched, its higher transaction fees may deter smaller businesses. However, for those targeting international audiences or looking for global payment gateways for small businesses in Asia, PayPal’s widespread acceptance and reliability make it a strong contender.

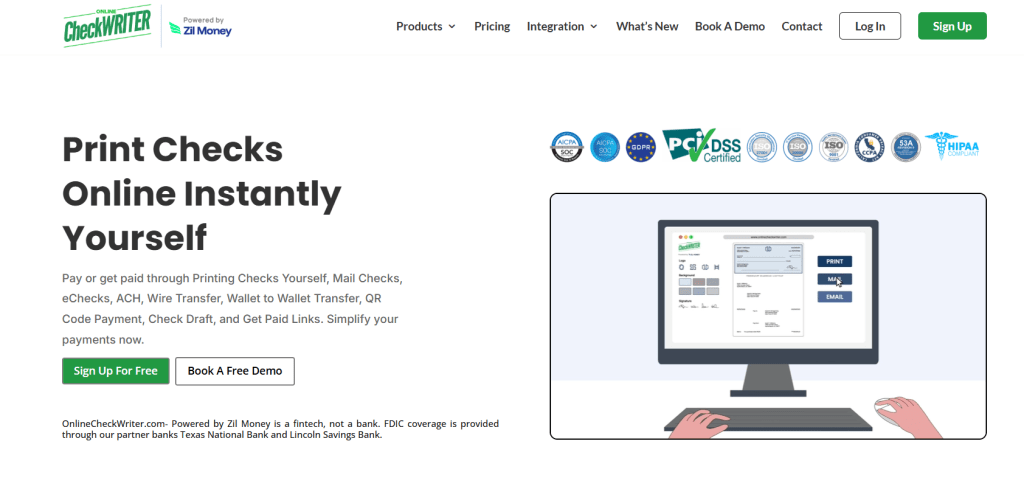

3. Online Check Writer

Online Check Writer is one of the best payment solutions for e-commerce in 2025 and is a unique payment solution catering to businesses that prefer check-based transactions. It is particularly popular among B2B e-commerce businesses and those managing recurring payments. Unlike traditional check systems, Online Check Writer allows businesses to issue digital and printable checks, significantly reducing processing time and eliminating transaction fees for check payments.

This platform is ideal for U.S-based businesses as it simplifies financial operations with features like automated recurring payments and integrations with accounting software. Its bank-level encryption ensures that all transactions are secure.

While it excels in affordability and practicality for domestic transactions, Online Check Writer’s limitation lies in its lack of international support. For U.S.-based small businesses looking for low-cost payment solutions, this platform offers a reliable and cost-effective way to manage payments.

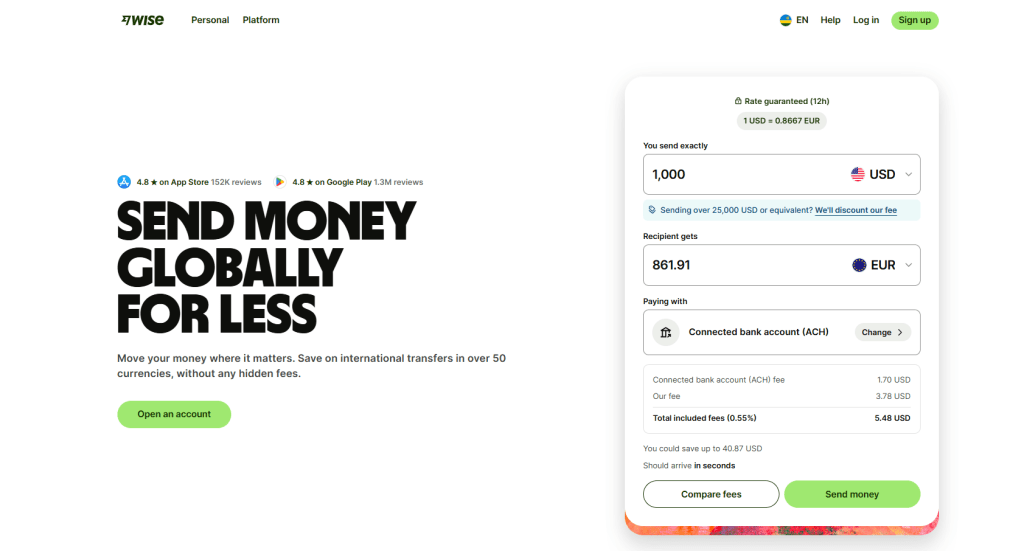

4. Wise

Formerly TransferWise, is a payment platform that focuses on transparency and affordability in international transactions. The platform’s distinction is its use of real exchange rates with low-upfront fees, making it ideal for businesses handling cross-border payments. Wise also offers multi-currency accounts, enabling businesses to receive and hold funds in over 50 currencies.

Wise integrates with major e-commerce platforms, allowing businesses to process payments efficiently. Its batch payment feature is particularly useful for companies that need to pay multiple suppliers or employees in different countries.

Despite its low fees and favourable rates, Wise supports fewer payment methods compared to other platforms, which may limit its flexibility for some businesses. Nonetheless, for companies prioritizing cost-effective international payments, Wise stands out as one of the top payment solutions for e-commerce in 2025.

5. Airtm

Another one of the payment solutions for e-commerce in 2025 is Airtm. It is an innovative payment solution designed to address the challenges of businesses operating in regions with currency instability or restrictions. The platform combines traditional fiat currencies with cryptocurrency support, offering a peer-to-peer marketplace for currency exchange. This allows businesses to bypass local currency restrictions and trade freely in global markets.

Free transfers between Airtm users make it a cost-effective solution for businesses with community-based operations. Its ability to facilitate cryptocurrency payments also positions it as an attractive choice for companies exploring e-commerce tools for accepting cryptocurrency payments. While Airtm’s unique features cater to niche markets, its scalability for high-volume businesses is limited. Nonetheless, it remains a strong option for businesses seeking secure payment options for Latin American e-commerce and regions with currency volatility.

6. Payoneer

Payoneer is a well-established payment platform, particularly popular among freelancers, service-based businesses and small e-commerce companies. With multi-currency accounts, it allows businesses to receive payments in various currencies and transfer funds to local bank accounts. Payoneer’s virtual bank details in different countries enable integration with global marketplaces like Amazon and Fiverr, making it a top choice for businesses targeting international clients. Instant transfers within the Payoneer network and low fees enhance its appeal for cross-border transactions.

However, Payoneer’s direct integrations with e-commerce platforms are somewhat limited compared to competitors like Stripe or PayPal. Despite this, its broad acceptance and reliability make it a preferred option for global payment gateways for small businesses in Asia and emerging markets. You can consider to incorporate it among payment solutions for e-commerce in 2025.

7. Stripe

Stripe is a powerhouse among payment gateways, renowned for its developer-friendly design and flexibility. It supports over 135 currencies and offers a wide range of payment methods, including digital wallets and local payment options. Its highly customizable APIs allow businesses to tailor the platform to their unique needs, making it suitable for both small startups and large enterprises.

Stripe provides advanced fraud detection and reporting tools, ensuring security and transparency. The platform’s integrations with e-commerce platforms and websites further enhance its usability. While Stripe’s customization potential is unmatched, it requires technical expertise to unlock its full capabilities. Nevertheless, it remains one of the top payment solutions for e-commerce in 2025, offering scalable solutions for businesses of all sizes.

Final Word

These top payment solutions for e-commerce in 2025 empower businesses with tools to navigate the challenges of global markets. Platforms like Flutterwave and Airtm excel in supporting emerging markets, while PayPal and Wise provide seamless cross-border payment options. These platforms cater to diverse business needs, ensuring secure, cost-effective and flexible payment processing. Whether you’re targeting specific regions like Africa or Latin America or exploring options for cryptocurrency transactions, these platforms empower businesses to thrive in a competitive market. Understanding their features and limitations will help you choose the best payment gateway for your business needs.